A Proposed Collecting Theme - Getting In Front of an Emerging Market

I had a great conversation over a meal with a former colleague a few weeks back, he reminded me that one of the approaches he took to his collecting (and dealing) was fairly left of field.

Most of us collectors like to accumulate coins or notes that relate to the history of our own time or country, he was no different. He'd built comprehensive collections of Australian gold coins (sovereigns and half sovereigns); pre-Federation banknotes; silver and copper coins; proof coins and pre-decimal notes. You name it, if it's a coin or note and it was issued for use in Australia, he helped build some of the finest collections ever formed.

As an adjunct to that activity though, he had other irons in the fire that posed different challenges and offered different rewards. His aim was to acquire assets (and help his clients acquire assets) in areas much further afield than our nation of Australia.

He acquired incredible rarites from the United Kingdom; United States; a range of countries in South East Asia, as well as South America and the Middle East.

Getting In Front of an Emerging Market

His logic was that if he could get in front of a market and buy those coins or notes that would be in keen demand with a larger number of collectors in 5, 10 or 20 years time, then he'd stand to make a lot more money than if he simply stuck within the confines of Australian numismatics.

The world numismatic market has seen several truly major moves in the coins of different nations and societies over the last 40 years or so. There was a time when British coins were not in particularly keen demand, so his clients acquired a wide range of historic gold and silver coins - proofs, patterns, hammered and milled. That market exploded in the early 2000's, and has gone from strength to strength since then.

Japanese coins had an incredible surge in the late 1980's; values of Chinese coins have obviously surged over the past 20 years - not just historic coins, but rare modern coins also.

The market for rare Indian coins - Zodiacal gold coins; silver and gold coins from the Mughal era; rarities from British India have all risen strongly over the past several decades.

I've had some minor activity in each of the above areas over the years, so I can only imagine just how satisfying it would have been to have taken the time to really learn about just one of those areas and then build a collection that had risen in value exponentially since it had been put together.

What Are the Next Areas of Growth in World Numismatics?

As I thought of each of those past opportunities for collecting satisfaction and reward, I immediately began to ask: "Where are the next areas of growth in world numismatics going to be found?" "What kind of a collection could I build that would benefit from a rise in the economic strength or importance of a particular country, region or society?"

It'd be fairly straightforward to pick one of the areas mentioned above and develop a collection inside it - learning about any area of foreign numismatics is more challenging than taking on the same task in Australian numismatics, if only for the lack of proximity we have to quality reference and market information. But while any one of them will prove to be a challenge, it'd be more fun to venture further out the risk curve and pick an area that doesn't yet have a solid track record of performance, that hasn't "popped" yet.

So how might we pick such an area? I expect there's going to be as much art as science in this process, but my own hunch is to begin by looking at economic forecasts for emerging markets, regions and nations for the coming decades, and choosing one that has solid expectations of economic growth.

Experts in Forecasting World Economic Growth - Goldman Sachs

Such forecasts I'd leave to the experts, so the source of information I'd use would be an economic powerhouse such as Goldman Sachs. They perform their research to guide investments at an exponentially higher scale, so I have confidence in using their prognostications to guide some thinking about which emerging markets could rise in prominence in the coming decades.

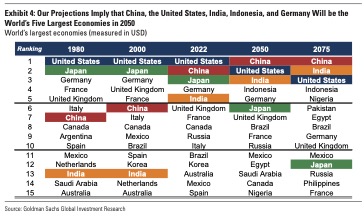

Their "Global Economics Paper", published online in December 2022, revisited forecasts Goldman Sachs had made two decades ago about the BRICs economies. In their 2022 paper, they published a table that ranked the 15 largest economies in the world (presumably measured by GDP) measured in USD.

Australia ranked 15th in 2000 and 13th in 2022. We are forecast to drop out of the top 15 by the time 2050 rolls around, but that table is the interesting one:

Goldman Sachs - Golbal Economic Paper 2022

Image Source: Goldman Sachs

Their comment on the composition of that table is: "In 2050, we project that the world’s five largest economies will be China, the United States, India, Indonesia, and Germany (with Indonesia displacing Brazil and Russia among the list of largest EMs over this horizon)."

So now we have a list of 15 countries who are forecast to be the largest in the world by 2050, a deadline that is still close to 30 years away as I write this.

This table shows significant changes in the global economic landscape between 2022 and 2050, with major shifts in power from developed to developing economies.

Rising Economies:

- China: Projected to claim the top spot, overtaking the United States. This rise is attributed to China's continued economic growth and strategic investments.

- India: Expected to jump to second place, demonstrating its burgeoning economy and large population.

- Indonesia: Enters the top 4, reflecting its growing influence in Southeast Asia and strategic location.

- Brazil: Rises to 8th place, highlighting its potential as a major economic player.

- Mexico: Climbs to 11th position, showcasing its economic progress and growing role in North America.

- Egypt: Makes a major leap into the top 12, indicating its potential for rapid economic development.

- Saudi Arabia: Enters the top 15, demonstrating the potential of its oil-rich economy.

- Nigeria: Makes a significant jump to 15th place, highlighting its potential as a major African economy with a large population.

Falling Economies:

- United States: Expected to relinquish its top spot to China, despite maintaining a strong economic presence.

- Japan: Slides down to 6th position, reflecting its aging population and slower economic growth.

- Germany: Drops to 5th position, potentially impacted by demographic challenges and global economic changes.

- United Kingdom: Falls to 7th place, possibly due to Brexit and economic uncertainties.

- France: Exits the top 10, highlighting the rise of other economies and its potentially slower growth.

- Italy: Falls out of the top 20, illustrating its economic struggles and aging population.

- Canada: Drops to 14th position, potentially due to competition from other emerging economies.

- Spain: Exits the top 15, possibly impacted by economic challenges and global competition.

Biggest Moves:

- India: Leapfrogs 1 position into #3, showcasing its rapid economic growth and potential as a future superpower.

- Indonesia: Enters the top 15 list for the first time and debuts at #4, highlighting its impressive economic progress and strategic location.

- Egypt: Also enters the top 15 for the first time and debuts at #12, demonstrating its potential for rapid development.

- Saudi Arabia: Enters the top 15 at #13, marking a significant rise on the global economic stage.

- Nigeria: Also enters the top 15 for the first time at #15, showcasing its potential as a major African economic powerhouse.

- United States: Drops 1 position, demonstrating China's economic ascendancy.

- Italy: Falls 9 positions, highlighting its economic struggles and demographic challenges.

Overall Conclusions:

This data predicts a significant shift in global economic power towards Asia and Africa, with China and India leading the charge. It is clear logic that these shifts are likely to have major geopolitical and economic ramifications, impacting international trade, investment flows, and global governance structures.

Based on the numbers alone, if I were to pick one country that shows potential for this exercise, I'd suggest that Indonesia is the clear winner. Their rise in economic strength is by far the largest out of all of the countries listed, (with respect to the rankings at least.)

To put that rise in rankings in dollar terms, Indonesia's GDP is projected to grow from USD 1.80 trillion in 2022 to USD 9.00 trillion in 2050, representing a cumulative growth of approximately 394%. To put the data in further perspective, Australia's GDP is projected to grow from USD 1.80 trillion in 2022 to USD 3.70 trillion in 2050, representing a cumulative growth of "just" 106%.

That they are also Australia's closest geographical neighbour makes them all the more appealing - via trade and tourism alone, Australia has reasonably close relationship with Indonesia. While most of the coins and notes that most Australians have brought back from our collectively innumerable holidays to Bali won't be the first items to be considered for a project like this, it at least shows there is the opportunity for some numismatic trade at least.

While India's rise may not be meaningful in terms of rankings (from 4th to 3rd), the scale of that change in dollar terms is such that it warrants attention. Australia and India share social and cultural ties via the British Commonwealth, and have done since Australia was first settled by the British. We have a modest familiarity with Indian coins, and as it is a fairly sophisticated market, there is a good amount of reference information available for study.

Brazil's rise of 3 places it well within our sights as having potenial for this exercise. Brazilian gold and silver coins first visited Australia's shores several hundred years ago now, so we have some familiarity with them.

There are a few other factors to consider before embarking upon a collection of coins or notes from any of these countries. Not only does the country need to have strong economic growth, we need to be able to identify those items within their numismatic landscape that will benefit from increased interest in the future.

Exotic Lingerie - It Doesn't Always Hit the Mark

Anyone that has ever bought their partner some exotic lingerie for their birthday will be keenly aware there is a difference between something that we think someone else might want and something that the person actually wants. Sometimes they are indeed the same thing, but when it comes to a long-term non-lingerie-related venture such as this, I believe its best to actually check with representatives of our intended counterparty what it is they consider to be a trophy before steaming in and buying them.

Indonesia is relatively young as an independent nation, and has a history that includes extended periods of colonial influence. There have been some incredible coins issued for use on or in the Indonesian archipelago by colonial authorities, but I wouldn't want to automatically presume that Indonesians in the 21st century aspire to collect them. They may have a slightly different focus or they may not.

The same can be said for India - it's relatively straightforward to learn about circulating coins, proofs and patterns struck under the Indian Republic (since 1947), but it's a lot more complex when we venture back into the Mughal era (prior to 1857).

Brazilian coins have a history that goes back at least 400 years - that's an incredible scope for the average collector to aim to cover! Choosing a segment of that history to focus on would clearly be required.

In future, I intend to cover off just what a plan of attack might be for each of the countries mentioned above - Indonesia; India and Brazil.

In the meantime, I'm really interested to hear - is the idea of building a collection of coins from a future economic powerhouse sound appealing? Which of the top 15 appeals to you and why? Or are you content to stick with coloured $2 coins, silver Kookaburras or pre-decimal coins? Leave a comment at the end of the page if you have thoughts either way.

I guarantee we're going to stick with each of those areas ourselves, we might just take a position in a few other areas as well to keep ourselves on our toes.

Comments (3)

A thought provoking read

By: David Ready on 17 January 2024Andrew, I find all your articles worth reading, and particularly this one as a buyers guide as to which countries' coins may appreciate most in the future. I thank you for putting 'pen to paper'. As a small time collector I have a small collection of Indonesian merchant's 'rooster' tokens and also like the small duit VOC coins. They go back several 100 years, don't cost much, and have lots of variety within their field and may increase a lot in value to new Indonesian collectors as their economy blossoms. India has a vast range of coins, and I think you get lots of errors ie brockages from there and they may feature in a specialized Indian collection designed to appreciate over time. Might be wrong ( and I am very poorly educated on this part of the world ) but cannot see South America with rampant inflation in many parts, ever being rich enough to warrant risking good money being spent on Brazilian coins that most likely will not go up in value. Just my thoughts and look forward to reading your 'plan of attack' for these countries.

Emerging markets

By: Steven Larkins on 3 December 2023Hi Andrew, Great article / strategy. Per Tavi Costa at Crescat Capital:- Emerging markets are the most undervalued compared to US stocks in over 50 years. Cheers

Proclamation Coins?

By: Ray on 2 December 2023From the interesting data and comments on expected movers, when thinking of nations that were colonized in past centuries, I couldn't help but think of our Proclamation coins.

Sterling and Currency Response

Ray, The proclamation and colonial coin series does include both Brazilian and (British) Indian coins, so it is definitely an accessible way of getting exposure to both of those rising markets, while still exploring our own national history - it's such an obvious conclusion I'm surprised I didn't think of it myself! Thanks for pointing it out.