Up for Sale - The Paradox of Physical Cryptocurrency

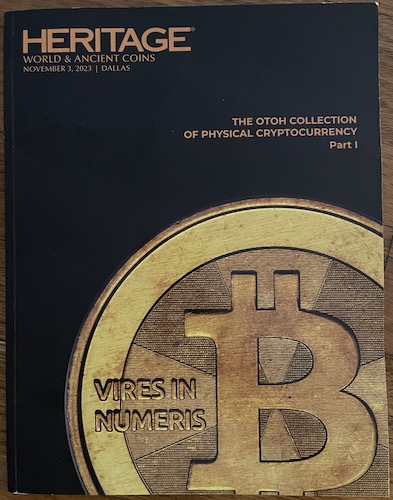

An interesting auction catalogue landed on my desk a few weeks back - it was for "The OTOH Collection of Physical Cryptocurrency", a pioneering sale in the world of numismatics.

The Otoh Collection of Physical Cryptocurrency

If you're anything like me, your brain may have gotten caught on a few of the words in that description - PHYSICAL CRYPTOCURRENCY!

Yes, if you didn't already know, physical cryptocurrency is not just a paradox, it is a real thing that exists in the world.

The "coins" in this auction were a series of Casascius tokens that had been purchased by a collector just after they were minted back in 2013.

The Casascius token was a project conceived by an American software engineer whereby tokens were embedded with a Bitcoin value - the digital access key is hidden beneath a hologram and remains intact for as long as the hologram remains unpeeled.

I remember seeing something about them in a numismatic periodical or blog when they were first publicized around 2011 - I thought: "Gee that's a pretty neat idea, I should get some of them." Sadly I didn't actually buy one (let alone some), and Bitcoin has of course blossomed in our consciousness ever since then. Keep in mind that the highest price for Bitcoin in 2011 was $31 (dollars, not tens of thousands of dollars!), so it was an expensive oversight.

The appeal of the project lives on however, so when I saw the catalogue for the Otoh Collection, I jumped online and bookmarked a few lots. It's a delicious irony that I was so busy this past week appraising a large collection (of physical coins) we're looking to acquire that I missed the cutoff for the auction, so missed out on buying one again!

Reviewing the prices realised for the sale is an interesting exercise.

The clearance rate was 100% - every single lot got away, the total turnover for the 250 lots was around US$7.2 million. Of the items listed, 150 of the tokens had a "peel" value of 1BTC, the remaining 100 tokens were 0.50 BTC. ("Peel value" in this context refers to the value of the Bitcoin included in the coin, much like we might refer to the "spot" value that a gold or silver coin has.)

As context for the following, the closing price for Bitcoin (according to CoinDesk) on the day of the sale was US$34,890.

What is interesting is that the premiums over "peel" were actually fairly modest - the highest premium over peel that one of the 1BTC coins made was 23.82%, paid for the second lot in the sale. The average of the 1BTC coins made a price equivalent to just 3.94% over their peel value. The highest price paid for a 1BTC was $43,200, the lowest was $33,600.

It was a similar story for the 0.5 BTC coins - the highest price was $21,000; the lowest was $16,800, the average premium was a slender 0.81%.

The overall results show me that there wasn't a great deal of demand at all for the coins / tokens over their underlying Bitcoin value. This isn't necessarily an indictment on their collectibility or rarity, because I should point out that this wasn't the first auction of a physical cryptocurrency - Casascius tokens have been auctioned infrequently by numismatic auction houses for years (I learned this after the fact), and many of them have brought large premiums over peel.

I recall a Noble Numismatics auction that I attended a few years back that had around 6 Type II Adelaide Pounds in it. This is a healthy number of an apparently rare coin to be offered in one sale, but they caught my eye and I viewed each of them. I prepared bids and attended the sale, and was successful in buying all of them (plus a Port Phillip gold quarter ounce that came up after them.)

I know that a few of the people in the auction room turned around and looked at me like I was completely out of my mind, so I know there can be times when the herd can get nervous when there's an abundance of opportunity on offer. Given the demonstrated demand for Casascius tokens at auction in the past, I can only think that the sheer number of Casascius tokens in this sale might have dissuaded some potential buyers from dipping their toes in the water.

I do know of one confident collector at least that was quite happy to steam in and pick some up - I said to him that I see no future where these items will not have a historical appeal to collectors.

This current phase of the evolution of money we're experiencing at the moment is well underway, and these Casascius tokens are the first physical representations of cryptocurrency, so they will always have a place as relics of the opening days of this phase of the ongoing evolution of money.

There is another auction of a much smaller batch of Casascius tokens coming up in a few weeks time, so if you have an interest in them, the ship has not completely sailed! The population of unpeeled tokens is shrinking day by day, you can see the population via this link.

Comments (1)

Historically the First Bitcoin Tokens will become

By: Aziz Sergeyevich on 9 November 2023This comment perplexes me "The overall results show me that there wasn't a great deal of demand at all for the coins / tokens over their underlying Bitcoin value”. The fact this virtual currency was trading at 5 cents in 2008/2009 is testament to the value in these historical pieces. Someone has created this piece which most likely cost them a maximum of $100 each just over a decade ago to produce, and are now selling for tens of thousands of dollars; hints to me the demand for this ingenious pairing. This is a timeless item displaying a revolution in currency towards the intangible digital space, yet this token expresses the intuitively human want to possess and hold a physical item - culminating in the duality of this token. Nothing less than one for the ages.

Sterling and Currency Response

Aziz, I guess the observation I was making was that while Bitcoin was at a tiny fraction of it's current value way back in 2008, the auction prices showed collectors or other buyers weren't particularly prepared to pay a premium over the peel value for them. The reason the items sold for tens of thousands of dollars was because the Bitcoin price held them at that level - if the Bitcoin price had been lower at the time of the sale, they would have brought less. If a gold coin sells for ten times the intrinsic value it has, we see evidence that collectors regard the rarity (and history etc) it has much greater than the metal value. If a gold coin sells for only a modest premium over its melt value, it demonstrates collectors don't particularly place much stock in it in that form. I agree these are historic pieces and capture the story of a pivotal point in the evolution of money, but their value doesn't yet consistently exceed their peel value.